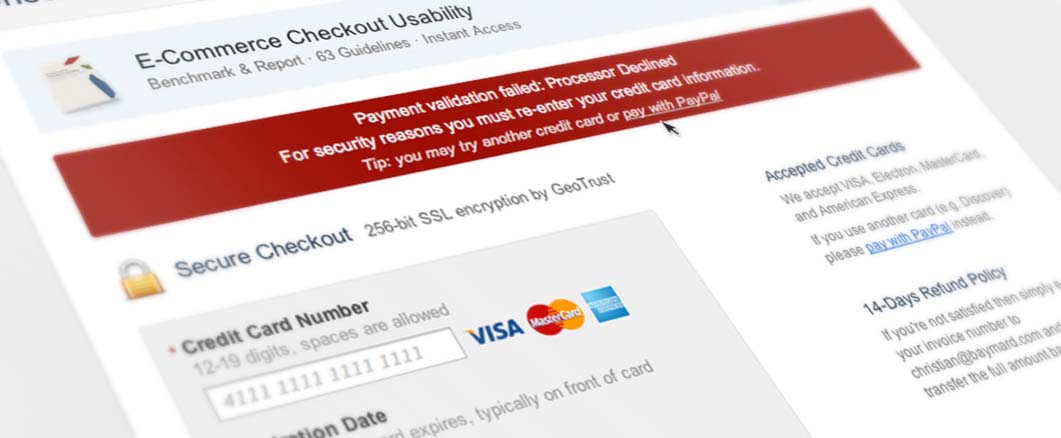

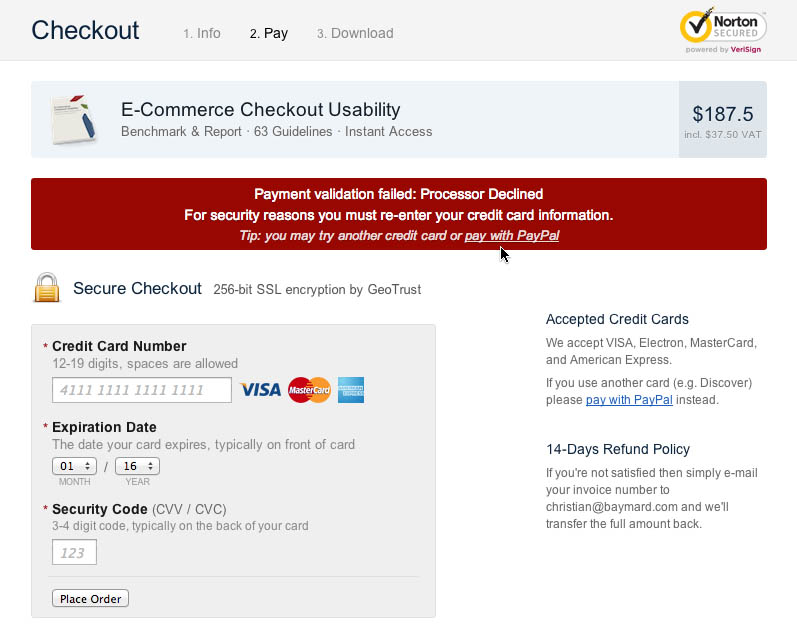

By offering alternate payment methods and checkout options directly from the error message you can recoup a significant portion of customers that would have otherwise abandoned due to ‘Card declined’ errors.

Despite spending a great deal of time optimizing your checkout process, following all the checkout usability best practices, there’s still that dreadful “Card declined by processor” – a leaking hole in many checkout processes, often taking a toll of as much as 2-5% of all potential sales.

If you’ve accepted credit cards online, and especially for an international audience, you probably already know the “Card Declined” errors far too well. For the uninitiated, “Card declined by processor” means that the potential customer’s credit card you’re trying to charge was declined somewhere in the processing network, typically by the cardholder’s bank.

Sales lost to “Card Declined”

“Card Declined” errors should not to be confused with errors in the credit card number, cardholder name or card security code – when getting the “Card declined by processor” error, the card information is often correct, the bank simply won’t let you charge the card.

This can typically be due to high card activity during a short time period, limitations on online or international orders, overly-sensitive fraud detection mechanisms refusing to let the transaction to go through, a temporary issue somewhere in the processing network, etc. Truly frustrating for the merchant, the bank’s specific reason for declining the charge is seldom given so the merchant can’t even provide proper support to the customer.

It’s not unusual that 5-10% (source) of online authorize / capture requests get declined in the first attempt (depending on product type, industry, etc). In good news, most customers do try a second time, and some even give it a third go or try with a different card if they have one, but hereafter, most will abandon - often believing the site is to blame - and with a very high risk of never returning to complete the sale.

Typically around half of the transactions will succeed in these second or third attempts, leaving the actual amount of lost sales due to “card declined” to 2-5%. That’s 2-5% of all your e-commerce sales most likely lost as a direct consequence of “Card declined by processor” errors.

How We’re Salvaging 30% of “Card Declined” Sales

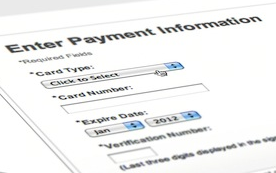

Now for the past two years, we’ve managed to recoup 30% of these 2-5% of customers that still get declined on a second attempt by utilizing a fairly simple technique at our site. In the credit card error message we simply suggest the user try out an alternate payment method, as seen below:

Now, simply asking the user to try a different card will not necessarily solve the issue, since the customer’s second card may have been issued by the same bank or tied to the same bank account, and thus covered by the same limits / reasons for decline. And any issues on the payment network will consequently also still be there. Therefore, you need to offer a completely new payment processor, and / or payment method.

Offering a New Payment Processor or Method on “Card Declined” Errors

The most straightforward solution is to offer one or more entirely new payment methods directly in your “card declined” error message.

This can be as simple as offering a third-party checkout such as PayPal, allowing those with a PayPal account to use that, and those without one to re-try their credit card using PayPal’s processing network instead of your card processing network. (Just remember to post all data the customer already typed during your checkout to the third-party checkout to pre-populate the checkout form as much as possible.)

This simple technique alone is what has salvaged 30% of those sales where a customer continually runs into a “Card declined by processor” error. (30% of the 2-5% = approx 1% increase in total completed online sales.)

The alternate payment method can however also be truly alternate, i.e. offering check, bank transfer or invoice payment – even if you don’t normally offer these payment methods to your customers. Remember that the extra manual processing expense associated with this will only be for a very small fraction of your customers that are otherwise very likely to abandon the sale altogether.

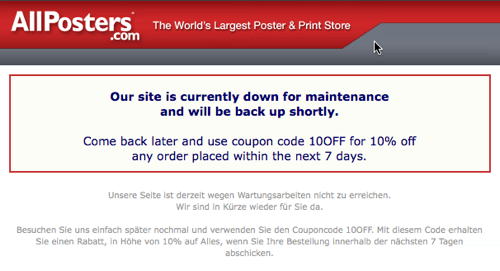

An additional benefit of offering an alternate payment method and/or complementary third-party checkout option, is that it eliminates a single point of failure in your e-commerce store. Before, when relying 100% on a single merchant account and processor, your entire online business could come to a screeching halt if they, for whatever reason, closed access to your account or otherwise became unavailable (natural disaster, system failure, bankruptcy, etc). With a fallback payment setup already in place you can, at any time, instantly switch primary checkout option and continue accepting orders. Sure it won’t be an ideal setup but it will certainly be better than having to turn away all customers while looking for and implementing a new primary payment method.

The More Advanced Solution

Depending on the size of your site you could take things even further and register for a separate “fallback” merchant account with a different provider than your current one (note: it’s important to use a different payment gateway / processor too for optimal results). Then, whenever a transaction is declined in the first attempt, you route the second payment attempt through your fallback merchant account and fallback processor to try the card in a different network.

If fully PCI compliant to handle credit card data on your own servers, you could even try the customer’s card in both payment processors on the initial submit; this way the “Processor declined” error would only be shown to the user after already trying the card at both the primary and the fallback credit card system. This would furthermore mean that you’d be certain the card info can’t be processed by your systems and you’d therefore be able to give more pointed directions, saying “Use another card or alternate payment method such as PayPal, Google Checkout or bank transfer.”

When you pursue this solution try to get both merchant account and payment gateway in a completely different geographical location from your current ones, as they will then likely use a different routing and processing network, eliminating temporary routing and network issues as the cause of the decline.

This fallback payment system can even be combined with the “alternative payment method” approach, for a total of 3 payment systems for the user:

- Normal credit card form

- Fallback credit card form + Error message (bypass this step if fully PCI compliant)

- Alternate payment methods + Normal or fallback credit card form + Error message

Getting Legitimate Transactions Approved

Of course merchants shouldn’t have to do things like this to get legitimate transactions approved, but the payment industry unfortunately has a track record of being notoriously ill-natured towards merchants. If up to 1% of all potential sales can be saved and customer experiences improved by implementing a fallback solution (which furthermore reduces one’s reliance on a single payment provider) then that’s a worthwhile strategy to pursue regardless of its circumstances.

Hopefully this article has given you some pointers on various fallback solutions, with the perhaps simplest approach to lowering “Card declined by processor” abandonments being a combination of smart error instructions (i.e. “try another card”) and offering an alternate third-party payment method (e.g. PayPal or Google Checkout). If you have the order volume to justify it, you may consider taking things to the next level with an actual fallback merchant account and intelligent processing implementations.